02021000 00 - Carcasses and half-carcasses. With the country still recovering economically from previous lockdowns an extension of the car sales and service tax SST exemption on all passenger vehicles has been announced during the 2022 National Budget presentation.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

How to Check SST Registration Status for A Business in Malaysia.

. Iv Choose specific items under Schedule C Item 1 2 or 5 read conditions and click agree to continue v Fill in the required fields in the application form vi Upon completion certificate will be produced with certificate number vii Print certificate viii Print approved exempted goods list optional. GST was only introduced in April 2015. Malaysia Sales Tax 2018.

5 Heading 1 Subheading 2 Description 3 02013000 00 - Boneless 0202 Meat of bovine animals frozen. Service tax a consumption tax levied and charged on any taxable services provided in Malaysia by a registered service provider in carrying out their. SST consist of 2 separate act.

Do note that services that are imported and exported are exempted. Registered SST payers are required to issue compliant sales invoices which must contain basic information including. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

SST Treatment in Designated Area and Special Area. It is extended for another six months from 1 January to 30 June 2022 for new CKD and CBU cars. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

Description of goods nature amounts weights unit prices etc or services. Type Name Modified. SCOPE CHARGE Sales tax is not charged on.

Service tax in Malaysia is a form of indirect single stage tax imposed on specified services termed as taxable services. 11 rows These attachment can be used for application of all item under schedule B. Or b imported into Malaysia by any person.

Goods and Person Exempted from Sales Tax. The Sales and Services Tax SST has been implemented in Malaysia. O Payment of SST has to be made Electronically.

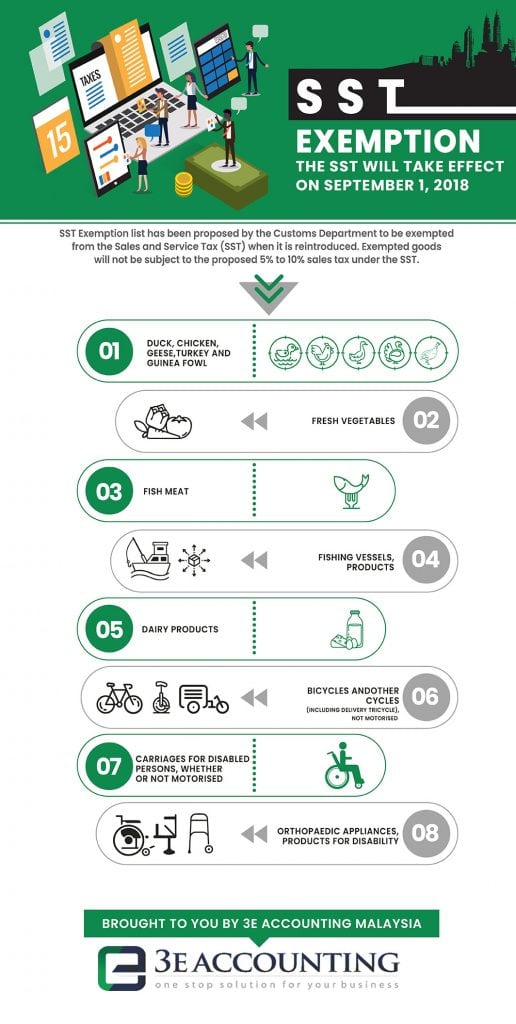

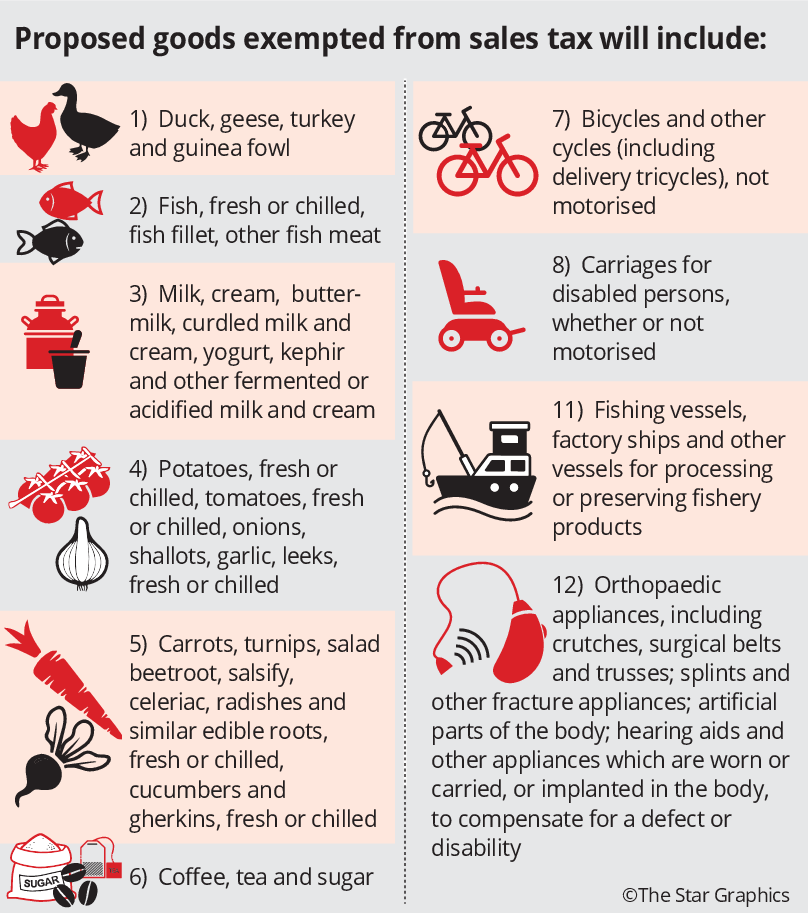

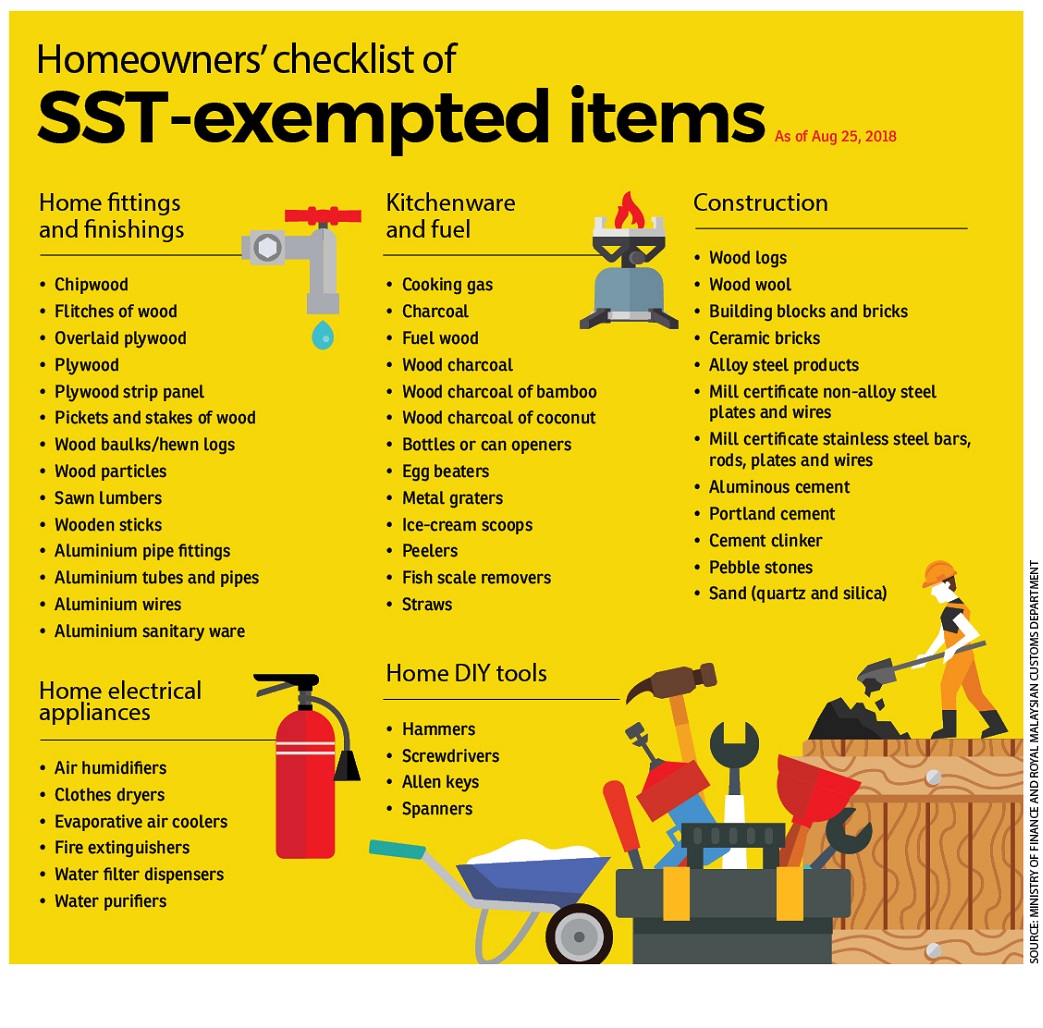

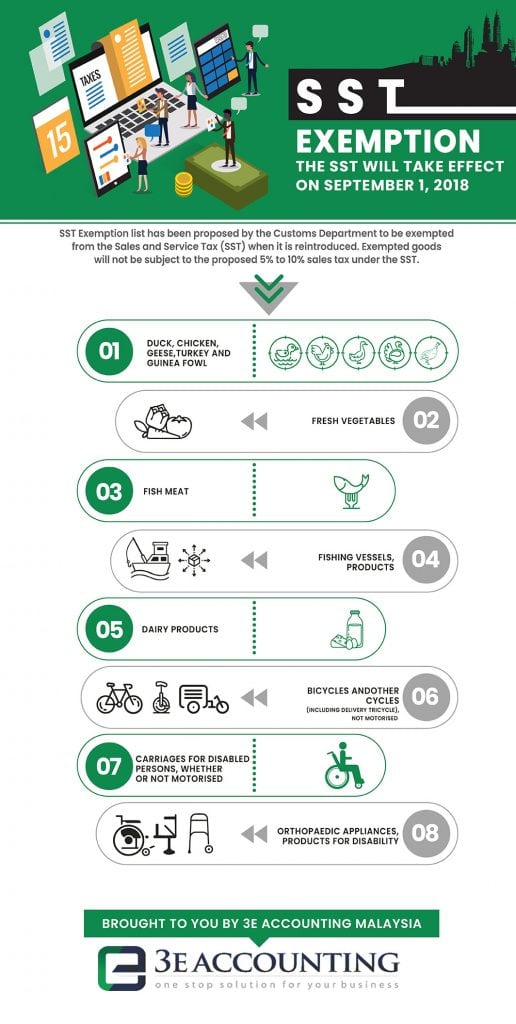

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy. The 292-page exemption list also includes bicycles and carriages for disabled persons as well as various types of orthopaedic. The SST has two elements.

Sales Tax Act and Service Tax Act. O Late payment penalty on the amount of sales tax not paid 10 - first 30 days period. Service Tax 6.

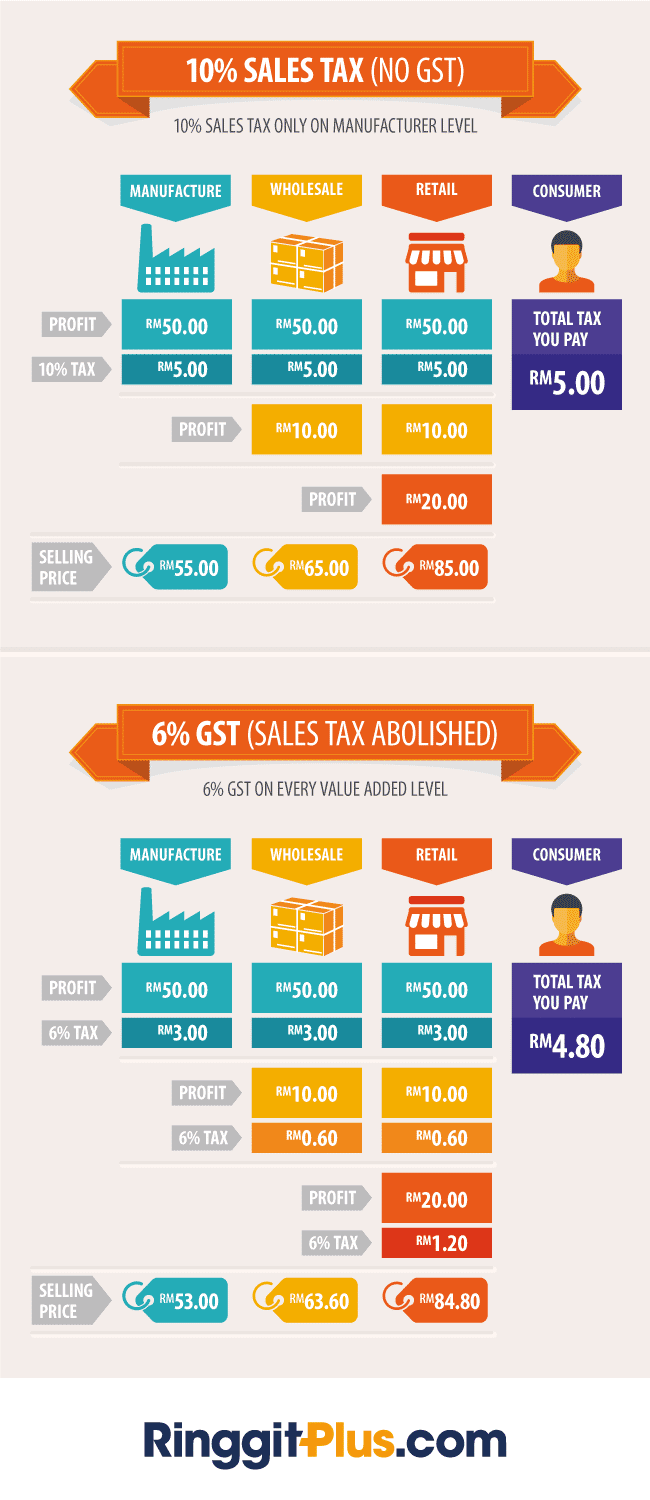

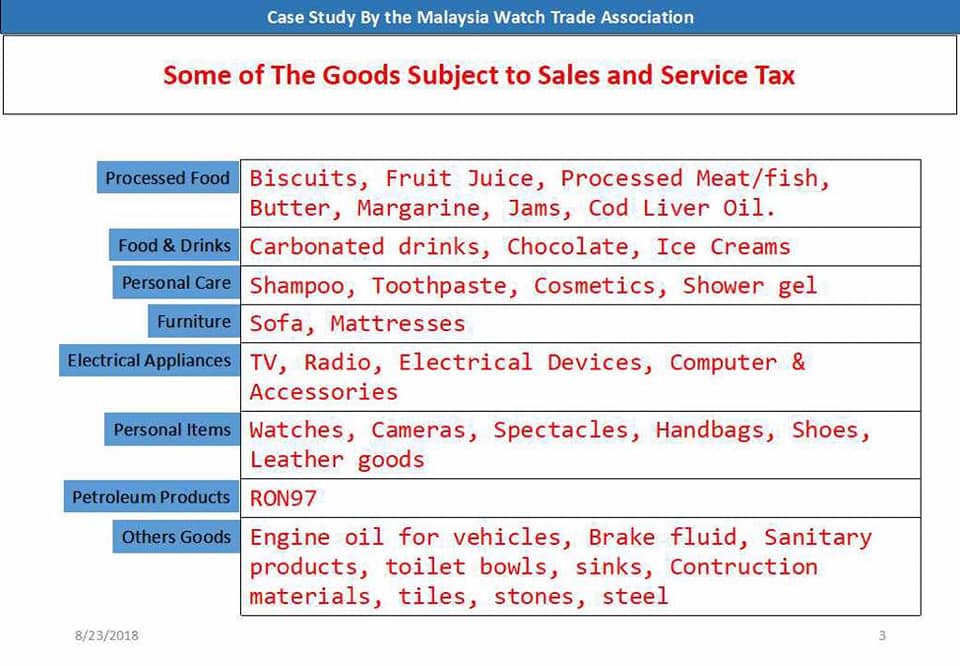

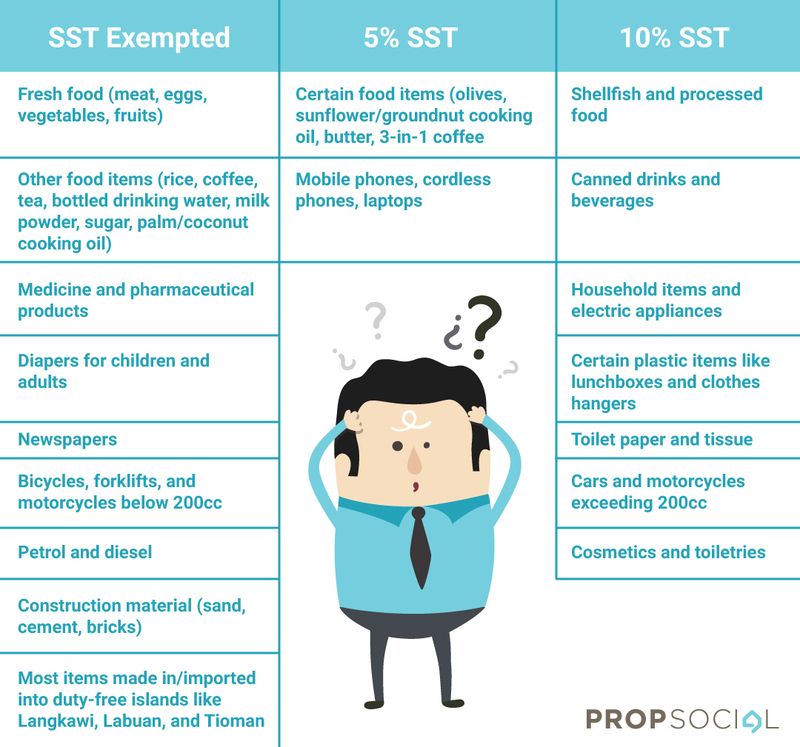

SST - List of Sales Tax Exempted and Taxable Goods Part 1 Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. Service tax cannot be levied on any service which is not included in the list of taxable services prescribed by the Minister under First Schedule of the Service Tax Regulations 2018.

Malaysia Service Tax 2018. Sales and Service Tax SST has replaced Goods and Service Tax GST in Malaysia since 1st September. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax.

SST Return Submission and Payment. Weve started a blog series to list down all items and their respective sales tax rate in detail. A list of consumer goods including poultry fish milk vegetables and various types of sugar has been proposed by the Customs Department to be exempted from the Sales and Service Tax SST when it is reintroduced.

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Or By cheque bank draft and posted to SST Processing Centre. Unique sequential invoice numbers.

Maximum penalty 40 after 90. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. Overview of SST in Malaysia.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. Hence we have come out with a blog series to list down in detail how each item should be charged under SST. Since 1st September 2018 Malaysia consumer tax has been replaced by a new tax system - the Sales and Service Tax SST.

Complete list of items and businesses affected by the Sales and Services Tax will be ready within two days. SST is administered by the Royal Malaysian Customs Department RMCD. Since the implementation of SST many are still confused on how to charge SST and how it works.

SST is compiled by 2 separate tax systems which is the Sales Tax and Service Tax. Name and tax ID of vendor. SST Penalties and Offences in Malaysia.

However since the start of 1 Jan 2020 digital services. The services include hotel and accommodation car hire rental and repair insurance domestic flight legal accounting restaurants electricity digital supplies Telecoms business consulting services. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments.

A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. The SST consists of 2 elements. SST Registration in Malaysia.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018. The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas.

15 - second 30 days period 15 - third 30 days period Note.

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Will Property Prices Come Down Rentguard

Sst Simplified Malaysian Sales Tax Guide Mypf My

Essential Items Will Be Exempted From Sst

Sst Simplified Malaysian Sales Tax Guide Mypf My

Sst Will Property Prices Come Down Rentguard

Sst Recording Sst Exemption In Treezsoft Treezsoft Blog

Malaysia Sst Sales And Service Tax A Complete Guide

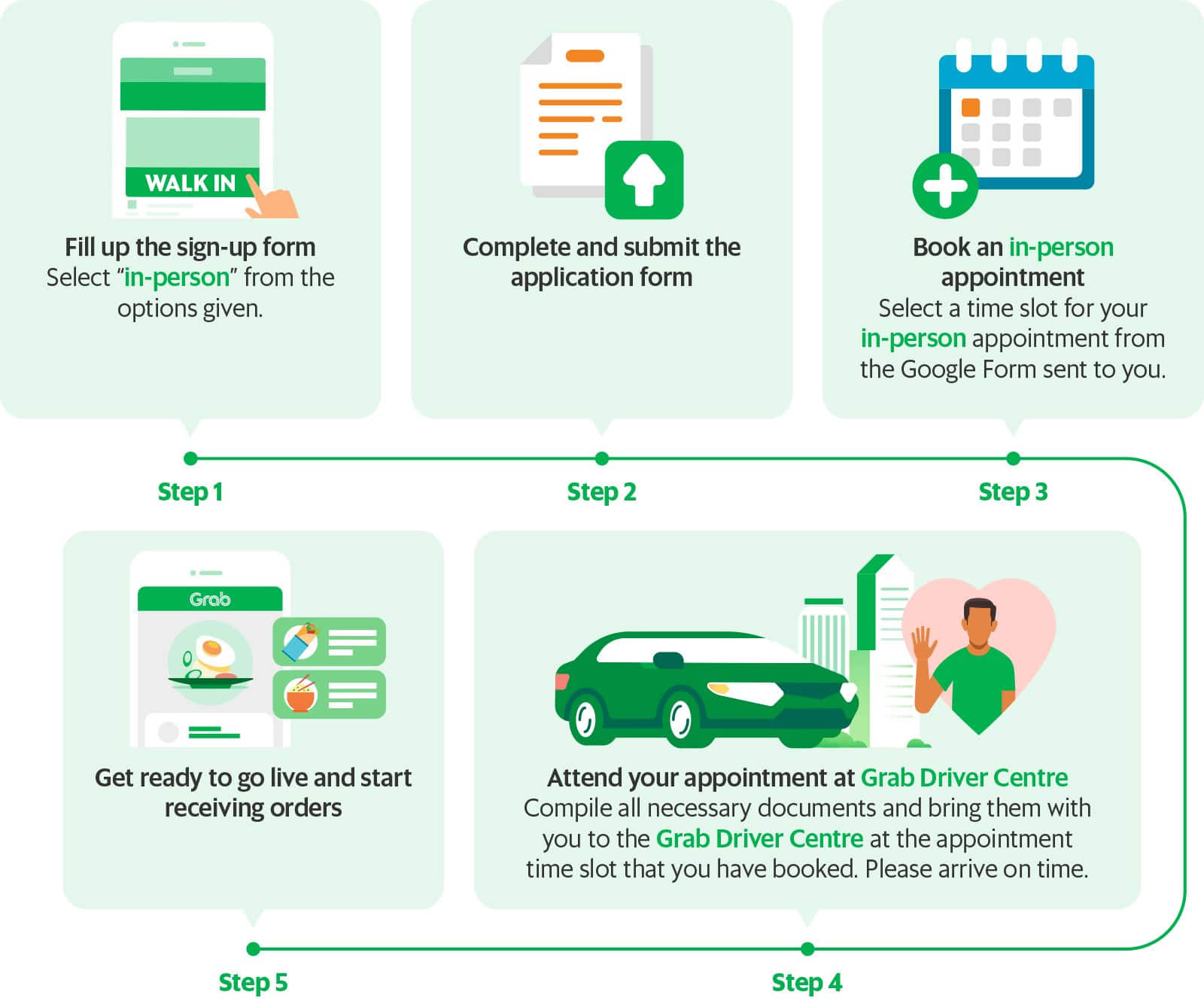

Grabmart Merchant More Consumers To Satisfy More Business For You Grab My

Malaysia Sales And Services Tax Sst Mwta

Sst Will Property Prices Come Down Edgeprop My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Goods And Person Exempted From Sales Tax Sst Malaysia

Welcome Back Sst So What S New Propsocial

Sst Will Property Prices Come Down Edgeprop My